Auto Enrolment

All your questions about auto enrolment, answered.

All your questions about auto enrolment, answered.

It’s a way of encouraging more people to save for when they want to stop working and retire. The Government made it law for all companies to automatically enrol certain employees into a pension scheme. This means that if you’re eligible you’ll only be asked if you want to opt out of the scheme, rather than if you want to join.

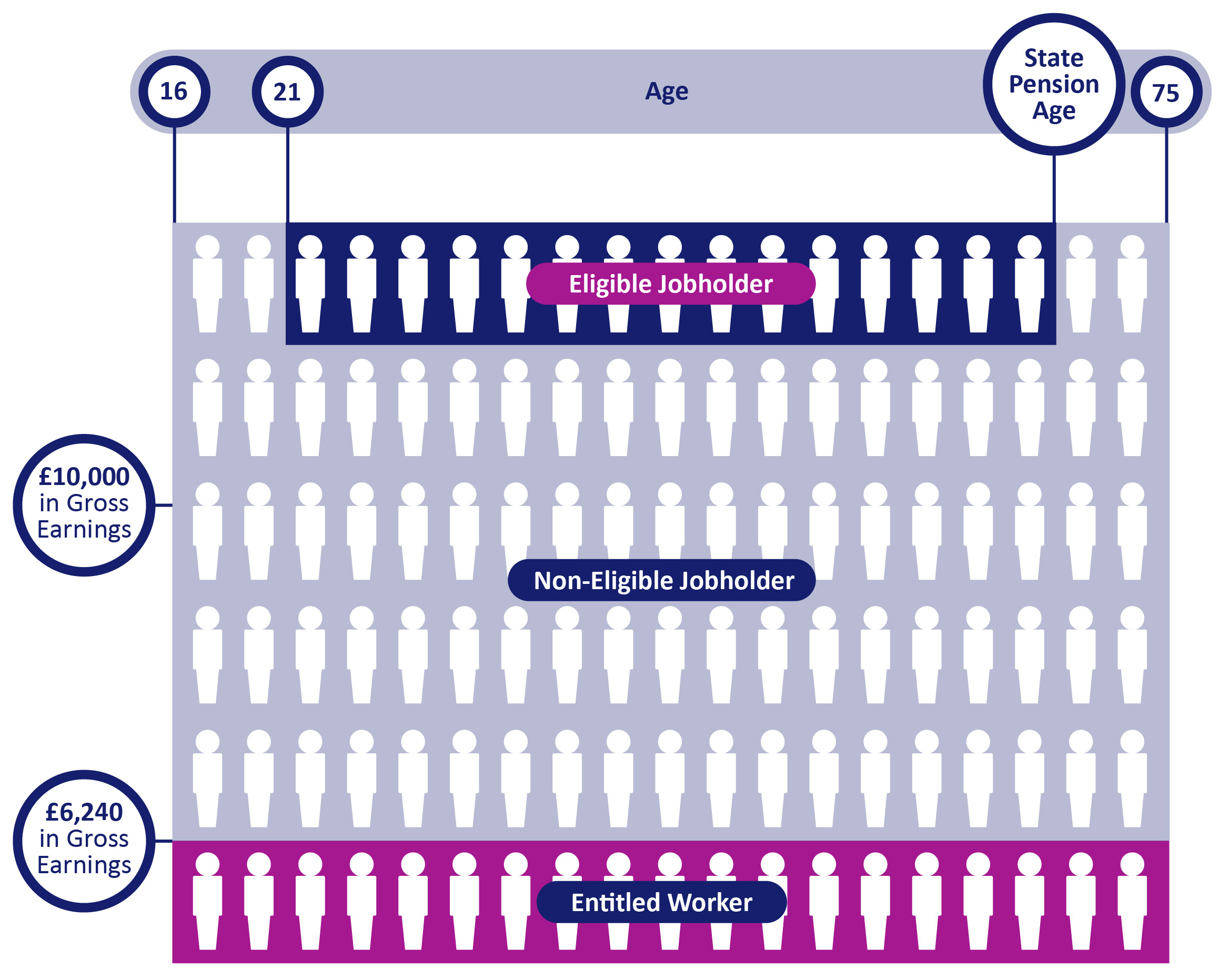

If you’re aged between 22 and State Pension Age and earn at least £10,000 a year then you will be automatically enrolled into a pension plan. You’ll sometimes see this referred to as being an ‘eligible jobholder’.

If you find you haven’t been automatically enrolled, it’s because you’re either classed as a ‘non eligible job holder’ or an ‘entitled worker’. Whether you are a non eligible job holder or entitled worker will depend on your age and how much you earn.

As a non-eligible jobholder, you can still opt into the workplace pension if you want to. An ‘entitled worker’ can be enrolled but may not receive contributions from their employer.

The amount you and your Employer must pay each month is shown as a percentage of your pensionable earnings (these are the earnings your payments are based on). This percentage has been increasing in phases, with the last increase having taken place on 6 April 2019. You can find out about these past increases by looking at your Scheme’s member guide. There are not currently any plans in place to increase these minimum contributions and we would advise you if the Government proposed further increases. Click here to go to your Scheme’s documents.

It means that if you’re eligible you’ll be automatically enrolled into your TPT Scheme if:

If you're automatically enrolled, contributions are paid into your pension as set out by the Government’s legislation. For further information click here to go to your Scheme’s documents.

If you have built up pension savings above the Lifetime Allowance and have enhanced or fixed protection, then you may lose this protection if you are automatically enrolled. If you have this protection, make sure you take appropriate action, so you don’t lose it.

You may find the information sources from The Pensions Regulator useful if you are an individual employee looking for information on workplace pension issues such as auto enrolment, potential pension scams or other pension options.

If you haven't registered for your Retirement Savings Account yet, click here to find out how you can do it